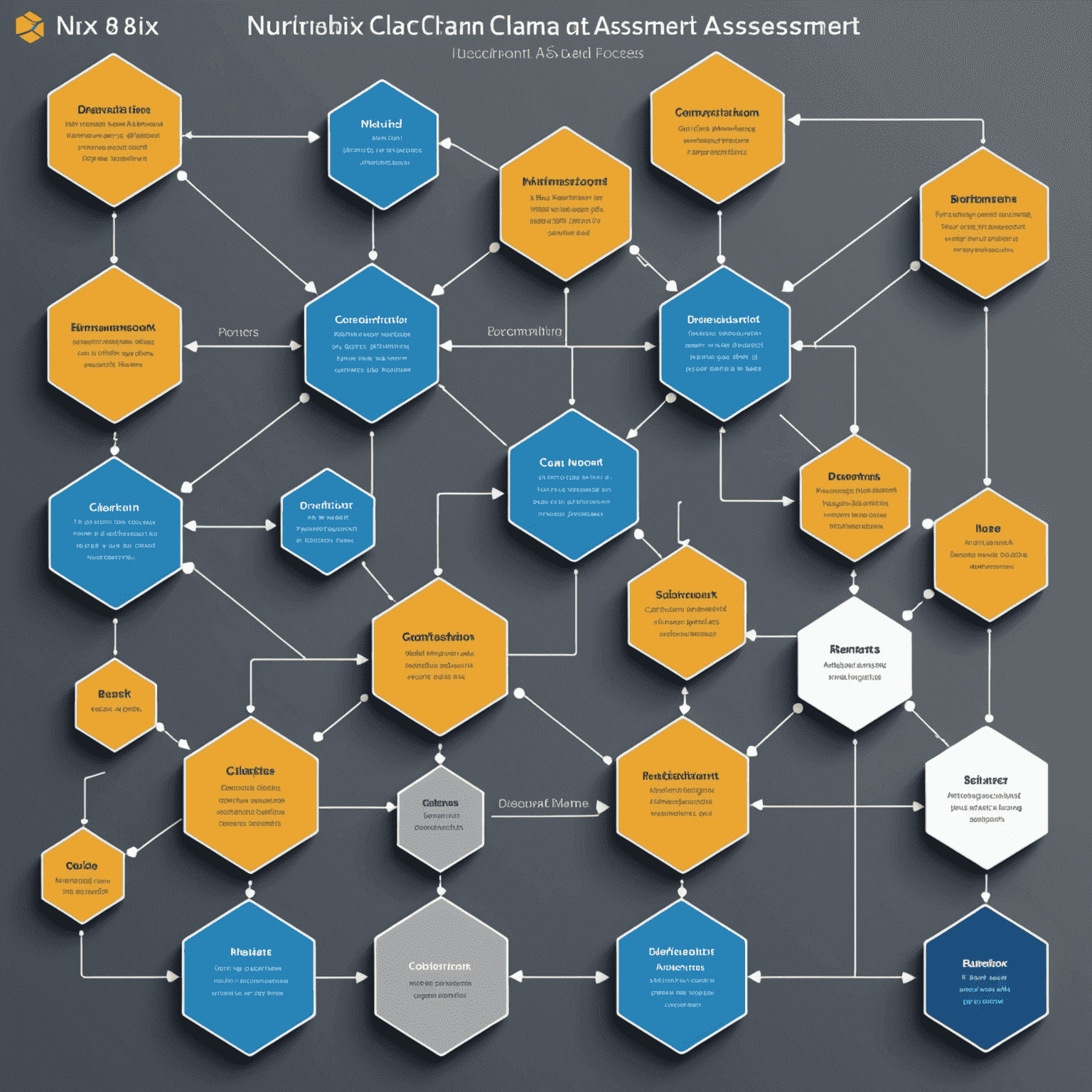

Claim Assessment Process at Nubrix

At Nubrix, we understand that filing an insurance claim can be a stressful experience. Our goal is to make the claim assessment process as transparent and straightforward as possible for our Canadian clients. Here's how we evaluate your insurance claim:

1. Initial Claim Submission

When you submit a claim, our team immediately logs it into our system. We assign a unique claim number and a dedicated claims adjuster to your case.

2. Documentation Review

Our adjusters carefully review all submitted documentation related to the insured event. This includes police reports, medical records, photographs, and any other relevant evidence.

3. Policy Verification

We verify the details of your insurance policy to ensure that the claim falls within the coverage limits and meets all policy conditions.

4. Loss Assessment

Our experienced loss adjusters evaluate the extent of the damage or loss. This may involve on-site inspections, consultations with experts, or analysis of repair/replacement estimates.

5. Claim Valuation

Based on the loss assessment, we determine the appropriate compensation amount, taking into account policy limits, deductibles, and any applicable depreciation.

6. Decision and Communication

Once the assessment is complete, we communicate our decision to you promptly. If the claim is approved, we provide details on the settlement amount and process. If denied, we explain the reasons and your options for appeal.

Our Commitment to Fair Assessment

At Nubrix, we are committed to conducting thorough and fair claim assessments. Our team of Canadian insurance experts works diligently to ensure that each claim is evaluated objectively and in accordance with the terms of your policy.

Trust Nubrix for a transparent and efficient claim assessment process in Canada.